When Choosing Credit Cards, Look Closely At The Fine Print When Your Parents' Financial Health Becomes Your Concern Choosing the most useful one is a personal preference, based upon your particular needs and the level of involvement most helpful. Using a money-management app can be a wonderful supplement to a typical financial routine. Additionally, iAllowance is unique in the joint aspect of the app, creating a platform for parents/guardians and teens to work together on money management habits and applications. What sets it apart from the previous two, though, is that it is geared to the more mature teen. Much like Smarty Pig and P2K Money, iAllowance is a money-tracking app. Unlike other tracking apps, Smarty Pig allows other users who have the app to contribute toward friends and family members' specific goals.

Best budget apps for android 2015 update#

The app lets users input money goals and then update the goals as benchmarks are met. This progress-tracking app is ideal for pre-teens and teens beginning to learn the real-life applications of financial literacy.

Best budget apps for android 2015 android#

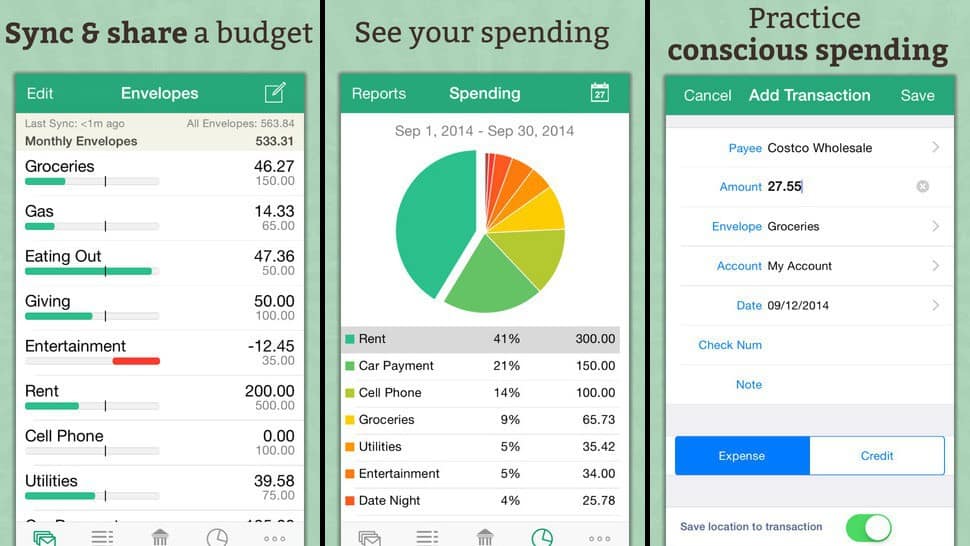

Related Link: Top 5 Personal Finance Apps: All Free And Available On iOS And Android One built-in function of the app is that it allows the user to earn additional money by completing household chores. Similar to the concepts introduced in Savings Spree, P2K Money develops the lesson further by documenting and tracking allowances. One of the most appealing aspects of this app is its subtle focus on risk and reward all in the name of educational entertainment. Designed as a game, this app teaches through play, introducing the concept that small purchases throughout the day, week or month add up and that the reverse is true as well – that even small savings, made consistently, can become substantial over time. Winner of the Parents' Choice Gold Award. By connecting any personal accounts, loans and credit cards, Mint allows easy access and tracking at your fingertips. Another neat feature of this app is that it can project when the debts will be paid off given the particulars of the repayment plan and interest rates.Īcclaimed by PCMag as Editors' Choice for personal finance smartphone app, Mint has been touted for its usefulness by many acclaimed personal finance advisors and companies alike. The app allows tracking customization by highest debt, balance or interest. Just as the name implies, Debt Payoff Planner aids users in establishing a sure-fire method of managing debt. Related Link: When To Talk With Your Kids About Finances One unique function of Manilla is its customizability, which can set up alerts for upcoming and outstanding bills. By allowing users to pay bills and track spendings, Manilla boasts ease of use and efficiency. The Manilla app functions as a digital file folder and bill pay service. Users establish a spending limit and subtract expenditures. While the app is not as fancy or connected as others on this list, its simplicity is what sets it apart. Similar to Toshl Finance, the Left To Spend app is budgeting in its simplest state. While the app requires more maintenance than Mint, it has the added benefit of instilling financial responsibility into the money matters equation. Expenses are logged and categorized by the user.

The checkbook ledger for the digital age, Toshl Finance helps young adults set monthly budgets and track expenses. Always within arms' reach, smartphones can become supplemental teachers and enforcers of money management.īelow are 10 recommended money management, financial literacy or budgeting apps geared toward blossoming financial geniuses. Teens and young adults who have come to age relying on technology are at an advantage when it comes to becoming financially savvy and independent. Luckily, in this era of technological advancement, there's an app (or 10) for that. Classrooms introduce money concepts early and, hopefully, the lessons are solidified at home by parents however, financial literacy and its practical applications are lifelong endeavors. While some may be more mathematically or organizationally inclined and find finances easier, the concepts are not bestowed upon us at birth. Managing money is a skill, not an inherent talent.

0 kommentar(er)

0 kommentar(er)